Financial App Market Competition Analysis 2025: How Players Are Shaping Growth

The Business Research Company's Financial App Global Market Report 2025 – Market Size, Trends, And Global Forecast 2025-2034

LONDON, GREATER LONDON, UNITED KINGDOM, December 23, 2025 /EINPresswire.com/ -- "The Financial App market is dominated by a mix of global fintech leaders and agile regional players. Companies are focusing on intuitive user experience design, advanced mobile banking features, and AI-driven personal finance automation to strengthen customer engagement and expand market reach. Enhanced security architectures, including biometric authentication and fraud-detection analytics, are becoming central to compliance and trust. Understanding the competitive landscape is essential for stakeholders aiming to capture emerging opportunities, scale digital offerings, and build strategic partnerships in a rapidly evolving ecosystem.

Which Market Player Is Leading the Financial App Market?

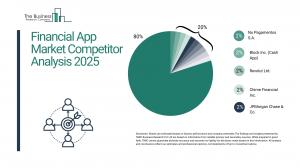

According to our research, Nu Pagamentos S.A led global sales in 2023 with a 2% market share. The company is completely involved in the financial app market, provides digital financial services, including no-fee credit cards, personal accounts, and high-yield savings. The platform provides instant payments, personal loans, and investment options. Users benefit from real-time expense tracking, secure transactions, and AI-driven financial insights, ensuring a seamless and efficient mobile banking experience.

How Concentrated Is the Financial App Market?

The market is fragmented, with the top 10 players accounting for 20% of total market revenue in 2023. This level of fragmentation reflects the sector’s relatively low entry barriers, rapid digital innovation cycles, and the growing demand for agile, user-centric financial solutions across global consumer segments. Leading players such as Nu Pagamentos (Nubank), Block (Cash App), Revolut, Chime, JPMorgan Chase, and Capital One maintain strong competitive positions through robust digital ecosystems, seamless mobile banking experiences, and trusted brand recognition, while numerous smaller fintechs cater to niche use cases and underserved demographics. As mobile-first financial services continue to scale and customer expectations for integrated payments, savings, and credit solutions rise, the market is expected to witness increased consolidation, strategic partnerships, and platform-level integrations that will further reinforce the influence of major players.

• Leading companies include:

o Nu Pagamentos S.A. (2%)

o Block Inc. (Cash App) (2%)

o Revolut Ltd. (2%)

o Chime Financial Inc. (2%)

o JPMorgan Chase & Co. (2%)

o Capital One Mobile (2%)

o PayPal Holdings Inc. (2%)

o One97 Communications Limited (Paytm) (2%)

o N26 GmbH (2%)

o Varo Bank N.A (2%)

Request a free sample of the Financial App Market report

https://www.thebusinessresearchcompany.com/sample_request?id=8911&type=smp

Which Companies Are Leading Across Different Regions?

• North America: Bank of America, Wells Fargo, Citigroup Inc., X Payments LLC, Goldman Sachs Group Inc., Block Inc., Robinhood Markets Inc., Multicent Markets Inc., SoFi Technologies Inc., Toronto-Dominion Bank (TD), Bank of Montreal (BMO), Spring Financial, Canadian Imperial Bank of Commerce (CIBC), Simplii Financial, Wise, PayPal, Mercado Pago, CoDi Banxico, Cashi más que efectivo, mi OXXO, Clip, Nelo and Payoneer are leading companies in this region.

• Asia Pacific: AMP Limited, Bank of Queensland, Commonwealth Bank, Hejaz Financial Services, Reliance Group, HDFC Bank Limited, Finvasia Securities Private Limited, Yes Bank Limited, CapFloat Financial Services Private Limited, Emizen Tech Pvt. Ltd., Peerbits Technologies Pvt. Ltd., Ant Group, Thunes Financial Services Inc., JD Digits, Lufax Holding Ltd., Du Xiaoman Financial, ICBC Technology, Smartpay K.K., PayPay Corporation, LINE Pay Corporation, Mer Pay Co. Ltd., Mizuho Financial Group, Kakao Pay, Toss, Naver Pay and K Bank are leading companies in this region.

• Western Europe: Unified Payments Interface, Lyra Network, Lydia, CaixaBank SA, Starling Bank, Plum, Lloyds Banking Group plc, Doshi, Money Squirrel, Revolut Ltd, Money Dashboard Ltd, Bankin and Shine are leading companies in this region.

• Eastern Europe: ETL GLOBAL, Crédit Agricole Corporate and Investment Bank, Up Romania, Alfa-Bank JSC, Spendee ApS, Twisto, Banca Transilvania, VTB Bank and Tinkoff Bank are leading companies in this region.

• South America: Afluenta, Ualá, MercadoLibre, Ripio, Nubank, Mercado Pago, PicPay, Vita Wallet, OnePay and mPOS TBK are leading companies in this region.

What Are the Major Competitive Trends in the Market?

• Innovative financial knowledge apps are transforming financial literacy, empower users with informed decision-making, provide interactive learning experiences, and promote better money management through accessible and engaging educational resources.

• Example: Lloyds Banking Group White-Label Financial Knowledge App (February 2025) assigns over 150 gamified lessons covering tax payments, credit card debt management, stock investing, and retirement planning.

• These innovative apps will first be available to 100,000 Lloyds student account holders as part of a pilot program.

Which Strategies Are Companies Adopting to Stay Ahead?

• Launching innovative money management tools to improve user engagement and retention

• Enhancing platform security and fraud detection through advanced encryption and biometrics

• Focusing on hyper-personalized financial insights powered by AI and user behaviour analytics

• Leveraging open banking APIs and cloud infrastructure to deliver seamless, scalable digital services

Access the detailed Financial App Market report here:

https://www.thebusinessresearchcompany.com/report/financial-app-global-market-report

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info"

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.